Practical and legal aspects when hiring expatriates should be considered by employers

In companies that invest in professional international mobility policies, the HR area plays an essential role in the development of business strategies, ensuring, among other things, that expatriates comply with local rules.

Legal and tax procedures must be observed in this labor relationship: visa type, contract formalization, composition of payroll and compliance with individual tax obligations.

The tax regularity of the individual can also have effects on their professional performance, making the matter important to companies that have foreigners on their staff.

Hiring expatriates is strategic and brings many benefits to the company, adding this experience and specialization to its operations. However, it is essential to plan this type of service provision and act in accordance with the rules in order to reduce tax risks and lawsuits in the labor courts.

Expatriates’ labor rights

In Brazil, every expatriate employee is covered by local labor laws, entitled to FGTS, PIS/PASEP and social security, as well as other common rights of Brazilian workers, such as vacation, 13th salary, among others.

Tax residence

The notion of a foreigner as a tax resident is an important concept to guide other understandings. Tax residency is related to the type of visa (with or without employment relationship) or length of stay.

Payroll and Income Tax

“Once you become a tax resident, the case for those who arrive in Brazil with a temporary visa with an employment relationship, payroll and income tax follow the same rules applied to a Brazilian worker”, explains Leonardo Bezerra, partner at DPC.

Since the income tax return is prepared partly based on information provided by the company and other paying sources, it is necessary to understand a few points.

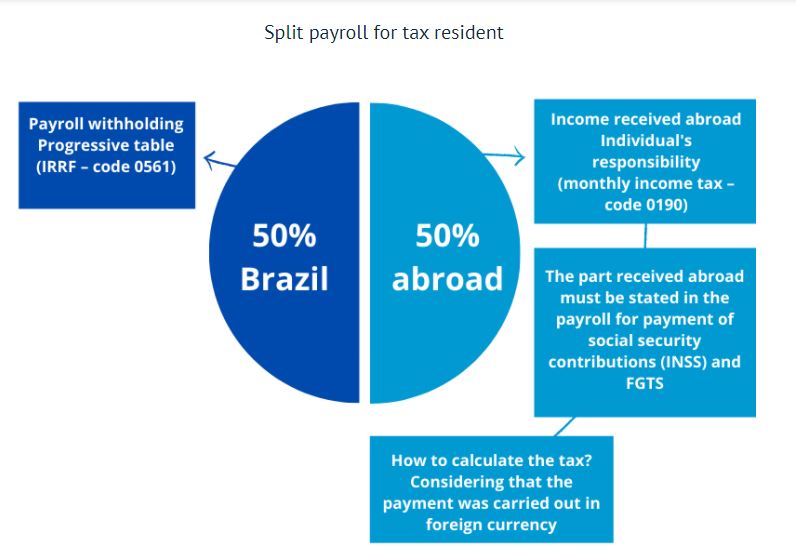

The employer/legal entity is responsible for the withholding on payroll, which must reflect the employee’s income for calculating Income Tax. But this is not always so simple, as it is not uncommon for a part of the payment to be made by the company in Brazil and another part by a foreign payer (split payroll).

The foreign tax resident in the country has the obligation to state here the income obtained on a worldwide basis, as well as assets and rights acquired in any other country.

When this expatriate has income from abroad, he is responsible, as an individual, for paying the monthly income tax.

The following example shows how the splitting of payment works, considering a case in which the salary is paid 50% by the company in Brazil and 50% by the company abroad (there are no rules for the percentage, which may vary for each employment contract). Issues related to currency conversion and quotation should also be considered.

Augusto Andrade, partner at DPC, draws attention to another important point. When an expatriate comes to work in Brazil without a relationship with a local company, but with a foreign employer, some precautions must be taken.

“Without an employment relationship, they cannot be paid with a bonus or salary by the Brazilian company, as this can lead to labor and immigration problems”, he warns. The expert advises that only paying expenses such as transport, food and accommodation is allowed, in this case.

Income tax for expatriates requires attention, as tax problems faced by foreigners can interfere with renewal and validity of the work visa, compromising corporate planning.

Reduction in payroll costs

Companies must also be aware of social security agreements signed between countries. These agreements can release the employer from contributing to INSS, leading to significant savings.

Currently, Brazil has the following bilateral agreements in force: Germany, Belgium, Cape Verde, Canada, Chile, South Korea, Spain, France, Greece, Italy, Japan, Luxembourg, Portugal, Quebec and Switzerland.

There are also multilateral agreements with Mercosur countries (Argentina, Paraguay and Uruguay) and countries on the Ibero-American peninsula (Argentina, Bolivia, Brazil, Chile, El Salvador, Ecuador, Spain, Paraguay, Peru, Portugal and Uruguay).

See also: Expatriates: companies can benefit from social security agreements

Support for companies and expatriates

Relying on DPC as a partner when preparing payroll and income tax of expatriates helps in the management of these professionals. Then, HR can dedicate itself to monitoring the skills and abilities of the foreign worker, supporting the individual in their adaptation and performance.

DPC provides advice to companies regarding:

- Application of international social security agreements to reduce social security charges;

- Adoption of remuneration policies together with the personnel department team, ensuring compliance with labor standards in Brazil (eSocial);

- Analysis of taxes and other tax obligations that apply to expatriates, analyzing each case, considering the form of service provision and receipt of amounts, as well as other income assessed in Brazil and abroad;

- International tax treaties are also considered to avoid double taxation;

- Assistance to expatriates in the calculation and issuance of payment slips for taxes due in Brazil.

This is a DPC content, Domingues e Pinho Contadores has a specialized team ready to assist your company.

Contact them by email at dpc@dpc.com.br

: